Forex manager account management experience and trading insights sharing:MAM & PAMM | Switzerland is the preferred investment destination for multi-account managers with significant capital

In addition to London and New York, the world's financial centers include Hong Kong and Singapore. In addition to the favorable conditions of zero capital gains tax in Hong Kong and Singapore, the small population in these regions is also conducive to the development of the financial industry. However, the disadvantage of Hong Kong and Singapore is that there are few forex banks. While there are numerous forex trading platforms available, retail investors are unable to invest and trade directly using bank accounts. They have to remit funds to the bank accounts of platform providers. For investors with a large capital scale, this risk is very high. There is also a major flaw. You must hold US dollars or local currencies. If you want to use currencies such as euros and pounds as margin, it will not work. Therefore, I only invest real money currencies exchange in Hong Kong and Singapore, and I do not participate in any forex margin investment projects. Switzerland has zero capital gains tax, and retail forex investors have separate accounts in forex banks. With a large capital scale, there is no need to worry about security issues. You can also use any of the eight major currencies as margin, which is beneficial for utilizing the currency post real exchange as margin, potentially leading to double profits.

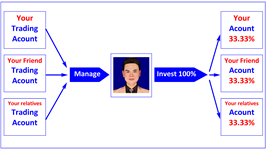

Account management experience and trading insights | Moving picture

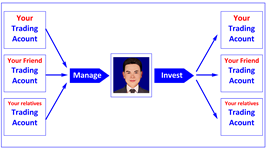

Account management experience and trading insights | Still picture

My office is near CHINA IMPORT AND EXPORT FAIR | Visit Office

Office is 2 stops away from CHINA IMPORT AND EXPORT FAIR

Office is 3km away from CHINA IMPORT AND EXPORT FAIR

Visit appointment 2 weeks in advance!

Scan Whatsapp contact me

Scan Wechat contact me